Our Response to Climate Change

Since its founding, the Curves Group has upheld the following Corporate Philosophy.

- Business Purpose:

- To create a society free from fears of illness, nursing cares and loneliness, filled with vitality for life.

- Our Mission:

- By spreading the habits of correct exercises, we will help our members and ourselves have a better life, and solve problems in our society.

Based on the philosophy, the Group has been operating as the community-based health infrastructure to contribute to solving social issues. We will put into practice sustainability management by striving to improve society and the environment in cooperation with all stakeholders including customers, our franchisees, and coworkers. As part of our initiatives, we disclose important climate-related information in accordance with the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD) framework as follows.

TCFD Framework

The TCFD framework is a scheme released by the Task Force on Climate-Related Financial Disclosures (TCFD) to help companies disclose the financial impact of climate change on their businesses. The framework comprises the following four elements.

・Governance

Disclosure of the organization’s system for examining climate change and how the results of the examination is reflected into corporate management

・Strategy

Disclosure of short-, medium-, and long-term impacts that climate change can have on corporate management and how the organization addresses them

・Risk Management

Disclosure of how the organization identifies, assesses, and manages climate-related risks

・Indicators and Goals

Disclosure of the indicators and goals used to assess and manage relevant risks and opportunities and to assess the organization’s progress toward targets

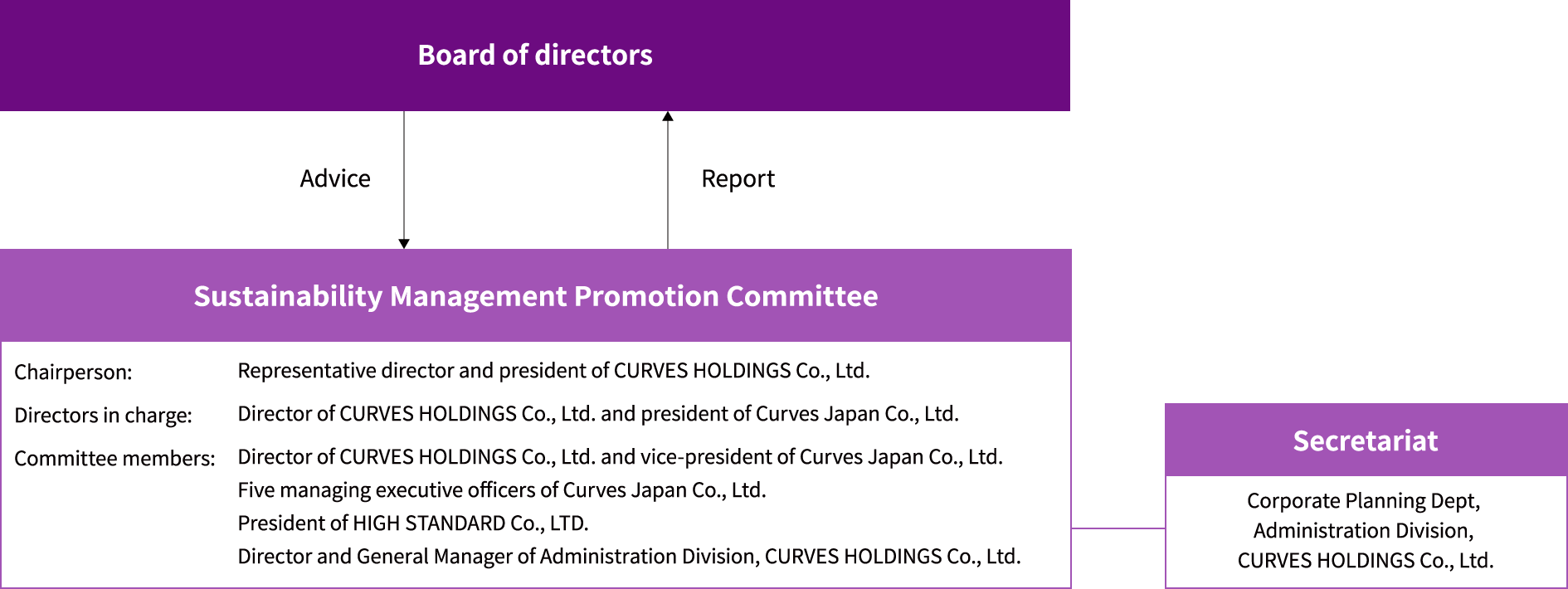

Governance

In November 2022, the Curves Group established the Sustainability Management Promotion Committee to promote sustainability management. The Sustainability Management Promotion Committee is chaired by the Representative Director and President, and the person responsible for it is the Representative Director and President of Curves Japan, a major subsidiary. Consisting of members responsible for different areas of business (i.e. presidents and managing executive officers of subsidiaries), the Committee meets once every quarter through Sustainability Management Promotion Meetings. The Corporate Planning Department at the Administration Division functions as the Committee’s secretariat.

At the meetings, the Committee identifies sustainability-related issues, sets goals, and manages progress towards their achievement. The content of these meetings is reported to the Board of Directors, and the Board of Directors is responsible for supervising and providing advice on Group-wide progress with initiatives related to ESG opportunities and risks and medium- to long-term goals.

Framework for Responding to Climate Change

(Sustainability Promotion Structure)

Strategy

Analytical process

Based on the risks and opportunities given by the TCFD recommendations, we examined the potential climate-related risks and opportunities for the Group’s businesses through the following steps.

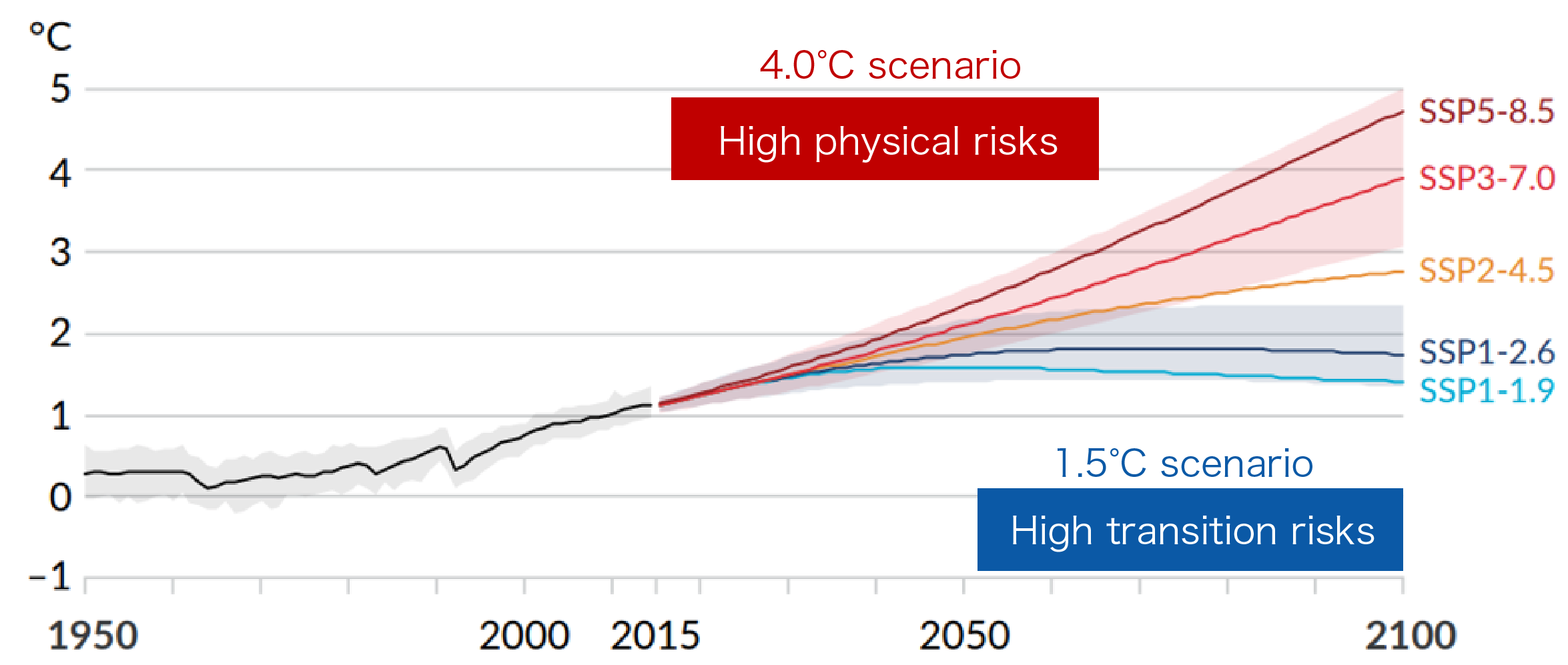

Moreover, based on the 1.5°C and the 4.0°C scenarios, we conducted analyses related to changes in policy and market trends (transition risks and opportunities) and physical changes caused by natural disasters (physical risks and opportunities).

Climate Change Scenarios

◆1.5°C scenario (Decarbonization Scenario)

A scenario in which proactive efforts are made more vigorously to achieve carbon neutrality and minimize the impact of climate change, and to limit average global temperatures rises to within 1.5°C of pre-industrial levels. In the 1.5°C scenario, impacts from policy and legal risks are expected to be much greater than in the 2.0°C scenario in terms of transition risks.

◆4.0°C scenario (High Emissions Scenario)

A scenario in which climate change countermeasures are not progressing from current levels, and in which average global temperatures are expected to rise by 4.0°C compared to pre-industrial levels by the end of the century. Impacts from physical risks such as increasingly intense extreme weather conditions and rising sea levels are expected to be significant.

◆Average global temperature changes with reference to 1850 to 1900

Source: IPCC AR6 Working Group I: Summary for Policymakers

Reproduced Figure SPM.8 from the IPCC AR6 Working Group 1: Summary for Policymakers

Impact assessments and countermeasure selection for risks and opportunities

Under the 1.5°C scenario, customers will demand low-carbon products and services in line with advancements in decarbonization. If we can respond to these demands, we expect to be able to take advantage of business opportunities and improve our brand image. A cost burden is also expected in line with carbon taxes and other government regulations. On the other hand, under the 4.0°C scenario, despite promotion of low-carbon and decarbonization measures, their effects will be limited. CO2 emissions will continue to rise, and risks associated with abnormal weather patterns and natural disasters will increase. As a result, stronger BCP measures will be needed both internally and externally.

| Risks and Opportunities | Impact from climate change | Time axis | Level of impact | Countermeasures | |

|---|---|---|---|---|---|

| Transition risks | Laws, regulations, and policies | Costs associated with the procurement of raw materials for merchandise will increase due to tighter regulations on GHG emissions among suppliers | Medium to long term | Medium | ・Cooperate with suppliers to gauge and reduce CO2 emissions ・Review and diversify the entire supply chain |

| Costs associated with the introduction of renewable energy will increase | Medium term | Minor | ・Switch to energy-saving facilities | ||

| Technology | Costs associated with the introduction of new equipment and upgrades will increase (air conditioning, lighting, and hot water equipment based on the ZEB-standard) | Medium term | Minor |

・Examine highly cost-effective equipment and upgrades ・Use subsidies for introducing equipment ・Formulate long-term equipment plans |

|

| Physical risks | Acute | Sales will decrease due to the suspension of operations caused by flood damage at clubs | Short term | Medium |

・Formulate and execute BCP ・Promote flood-prevention measures ・Subscribe to appropriate insurances |

| Supply disruptions and lost opportunities will occur due to disasters or the suspension of production at factories where we outsource merchandise production on an OEM basis | Short term | Major |

・Review and diversify the entire supply chain ・Coordinated risk aversion with suppliers |

||

| Supply delays and lost opportunities will occur due to temporary disruptions to supply chains for merchandise raw materials caused by floods and typhoons | Short term | Major |

・Review and diversify the entire supply chain ・Coordinated risk aversion with suppliers |

||

| Suspension of operations and services will occur due to the destruction of data centers and the loss of data caused by abnormal weather such as floods and large-scale typhoons | Short to medium term | Major |

・Select areas that are unlikely to be impacted by natural disasters for data centers ・Formulate and execute BCP |

||

| Chronic | Raw material prices will soar due to a decrease in supply volumes caused by rising temperatures | Medium to long term | Major | ・Review and diversify the entire supply chain | |

| Relocation costs will arise due to the need to reassess club locations in the medium to long term in response to rising sea levels | Long term | Minor |

・Formulate and execute internal BCP ・Carry out thorough risk assessments when opening new clubs |

||

| Opportunities | Energy sources | Brand image will improve thanks to greater reputation among customers | Medium term | Medium |

・Continuously disclose information for stakeholders ・Reinforce responses to external ratings including CDP. ・Proactively implement capital investments related to energy-saving and renewable-energy technologies |

| Resilience | Brand image will improve thanks to ensuring resilience through early restoration of business in times of disaster | Medium term | Minor |

・Formulate and execute internal BCP ・Reinforce disaster preparedness equipment ・Create regional cooperative structure for times of disaster |

|

| Market | The need for exercise to boost immunity against the spread of infectious diseases will increase | Long term | Major |

・Reinforce hygiene management and infection prevention measures in facilities ・Provide fitness programs that boost immunity |

|

[Time axis] Short term: Within 1 year; Medium term: 1 to 10 years, Long term: More than 10 years

Risk Management

Processes to identify, assess, and manage climate-related risks

At the Curves Group, the Board of Directors meetings and the management meetings, which are held monthly, identify, assess, and manage risks related to climate change as necessary. Moreover, to respond to risks related to climate change that have been identified and assessed, the Sustainability Management Promotion Committee identifies issues, sets goals, and manages progress. Each business department is responsible for executing risk countermeasures. These processes are followed by the Sustainability Management Promotion Committee at its quarterly meetings, and the details thereof are reported to the Board of Directors. The Board of Directors then provides appropriate advice on the issues and initiatives.

The integration process into company-wide risk management

The climate change risks managed by the Board of Directors and the Management Committee are evaluated for their significance within the company-wide risks and prioritized accordingly. This enables the establishment of an integrated risk management system.

Indicators and goals

To assess and manage the impact of climate-related issues on management, we have calculated Scope 1 to 3 GHG emissions based on the GHG Protocol standards. Additionally, as one of our GHG reduction targets for the Company and its domestic subsidiaries, we are aiming to become carbon neutral by 2050 in terms of Scope 1 and 2 emissions.